Equity capital for

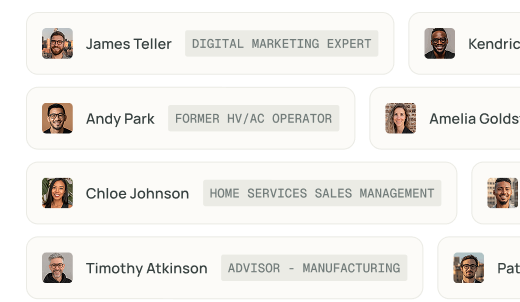

seasoned operators buying enduring SMBs

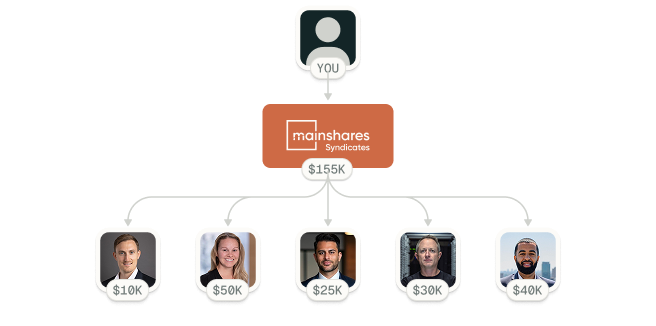

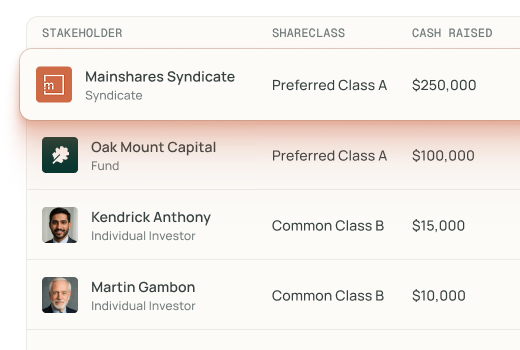

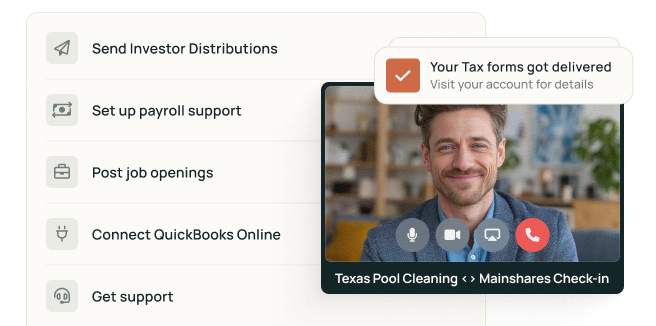

Mainshares is investing in the future of Main Street by backing small business acquisitions alongside mission-aligned investors.

Jacob acquires local flooring manufacturer, Floors Galore

Flooring / Jacksonville, North Carolina

Joseph successfully closes on Point B Communications

Digital Agency / Chicago, Illinois

Disclosure: This website (the “Website”) is owned and operated by Mainshares, LLC (“Mainshares”). By accessing the Website and any pages thereof, you agree to be bound by Mainshares’ Terms of Service and Privacy Policy. The information contained herein is provided for informational purposes only and is not intended to influence any investment decision or be a recommendation for any investment, service, product, or other advice of any kind, and shall not constitute or imply an offer of any kind. The products and services offered by Mainshares are not offered by a certified public accountant (“CPA”) and should not be considered as a substitute for services provided by a CPA.

Mainshares does not make investment recommendations and no communication, through this Website or in any other medium should be construed as a recommendation for any security offered.

Should you be presented with an investment opportunity, such investment opportunities involve private, unregistered securities that are speculative and involve substantial risk. These investment opportunities are conducted in accordance with an exemption from registration, specifically relying on the private offering provision outlined in Section 4(a)(2) of the Securities Act of 1933, along with compliance with Rule 506 of Regulation D. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. There is always potential to lose money when you invest in securities or other financial products. Private placements lack liquidity and distributions are not guaranteed. You are strongly encouraged to seek professional advice prior to entering into any transaction for any securities and to consider your investment objectives and risks carefully before investing.

Neither the SEC nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided herein or through any references/links herein. There can be no assurance that any valuations provided by issuers are accurate or in agreement with market or industry valuations. Mainshares does not make any representations or warranties as to the accuracy of such information.